Cost Of Long Term Care Insurance At Age 75

Long Term Care Insurance Option For Seniors Between 75 and 79 Explained. Average Cost - Single MALE.

Tax Deductible Long Term Care Insurance Tax Limits Ltc Federal Tax Limits State Deductions For Long Term Care

2700 for a female.

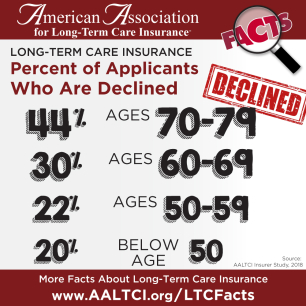

Cost of long term care insurance at age 75. Los Angeles CA Aug 5 2015 Finding long term care insurance coverage after age 70 is difficult as leading insurers scrutinize health and most stop issuing new policies after age 75. Term Life Insurance Rates for 70 75 Year Olds. Life insurance rates for seniors over 75 will vary but you must have good health to qualify for term coverage at this age.

The cost goes up as you get older. According to the 2020 long term care insurance Price Index the costs for LTC insurance can vary significantly. Life Insurance Rates for Females Age 75 to 80.

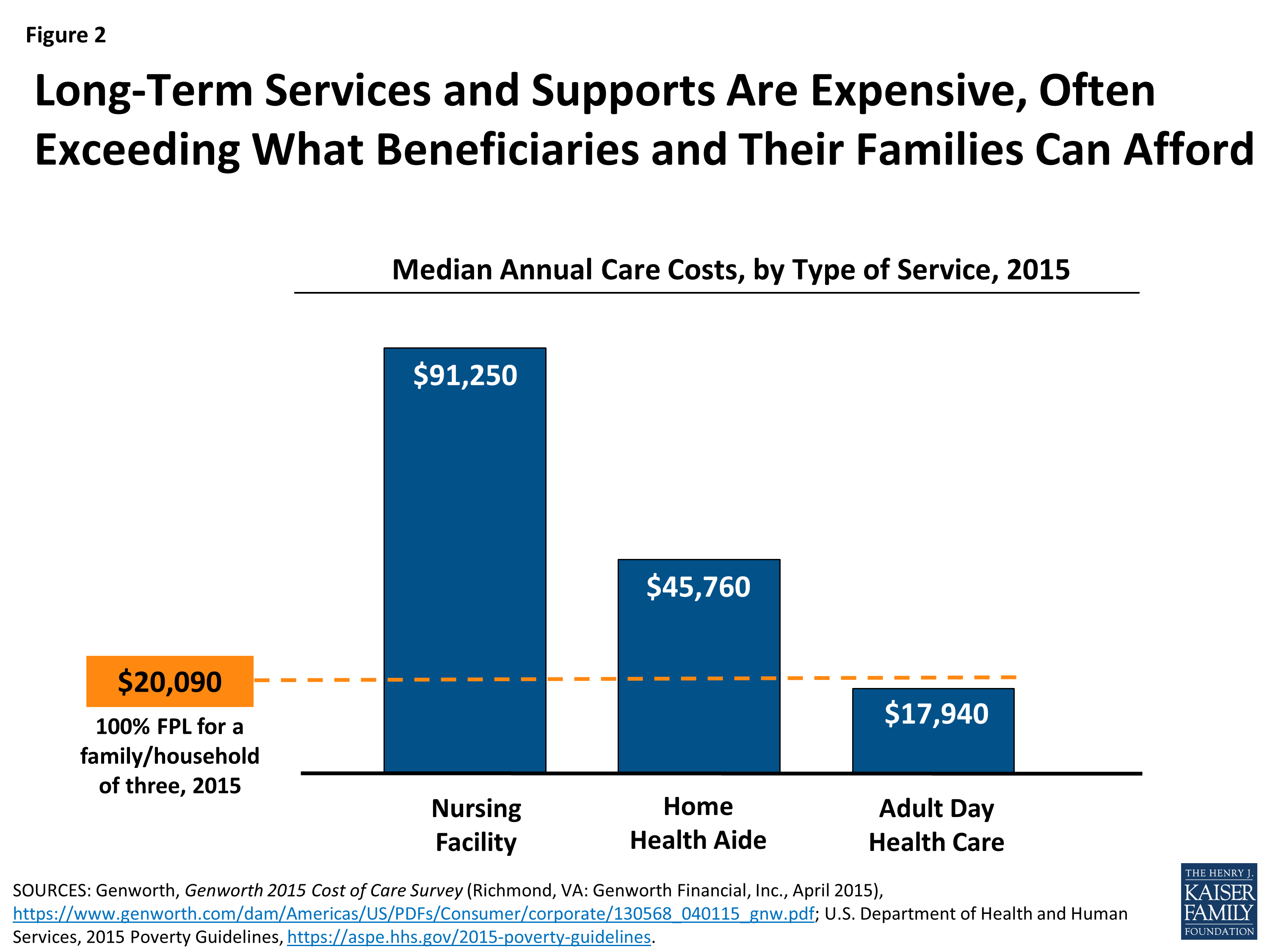

Long Term Care Insurance Options. According to the American Association of Retired Persons AARP the average annual cost for long-term care insurance that pays a maximum of only 150 a. Average Long Term Care Annual Premium for a 60 Year Old For Initial pool of benefits equal to 164000.

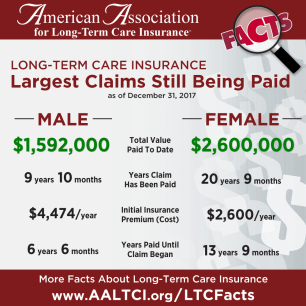

How Much Does Long-Term Care Insurance Cost. However here are some average costs for 2018 as provided by the American Association for Long Term Care Insurance. 75-year-old females in great health can get 100000 in term coverage for as little as 70 per month for a 10-year term policy.

Average Long Term Care Annual Premium for a 55 Year Old For Initial pool of benefits equal to 164000 each at age 55. Your money pays for long-term care insurance but your health actually buys it Slome explains. The Long Term Care Partnership Program.

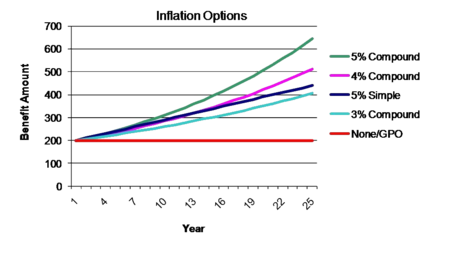

The cost of long-term care insurance is dependent upon a variety of factors such as age the daily allotted benefit the number of days or years that the policy will pay current health and the types of benefits added into the policy. For example if that same couple purchases a policy at age 60 their prices rise almost 1000 to an annual average of 3381. The price for a couple both age 55 purchasing new long-term care insurance coverage can be as little as 3000 or as much as 6300 for virtually identical insurance protection according to the findings of the American Association for Long-Term Care Insurance.

COST FOR COVERAGE AT AGE 75 some health issues MALE 162000 of coverage 3 years no inflation growth 4638-per-year. This is a story that happens more than you might think which is why we encourage consumers. These rates are for a 10 year term life insurance policy at age 70 -75.

According to the American Association for Long-Term Care Insurance the average long-term care insurance policy costs 2466 per year for a couple at age 55. To find a long-term care insurance specialist call the association at 818-597-3227. The just-released 2020 Long-Term Care Insurance Price Index for 55 year old purchasers reported pricing for single men single women.

A 55-year-old man in the United States can expect to pay a long-term care insurance premium of 1700 per year on average according to a 2020 price index survey of leading insurers conducted by the American Association for Long-Term Care Insurance AALTCI. That will cover 164000 in benefits when the policyholder takes out the. According to the Associations 2020 pricing index a 75-year-old female applicant would pay 7215-per-year for similar levels of coverage.

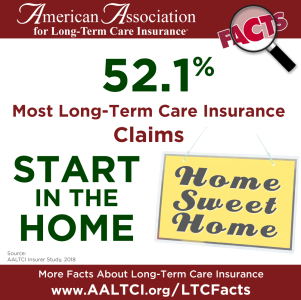

There are different types of long-term care insurance options yet most fall under conventional or stand-alone long-term care insurance or hybrid policies that combine other types of financial products such as life insurance with an LTC rider. However a report from the Chartered Insurance Institute CII in 2016 showed that the average man aged over 65 will need to spend around 37000 on later life care while that rises to 70000 for the average woman of the same age. Long term care insurance is issued based on the insurance companys medical underwriting.

A new video posted by a trade group explains an option worth considering. So many variations and so many bells and whistles exist that its hard to give an accurate cost. At the age of 70 passing these qualifications may be hard.

Carol finally came to her senses at the age of 77 after recognizing the fact that long term care does pose a real risk to seniors retirement and it makes more sense to insure against the risk than it does to ignore it. The average policy today for a 55-year-old male costs about 2000 a year. The Long-Term Care Partnership Program is a federal.

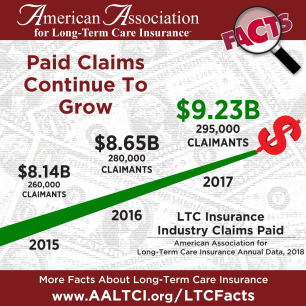

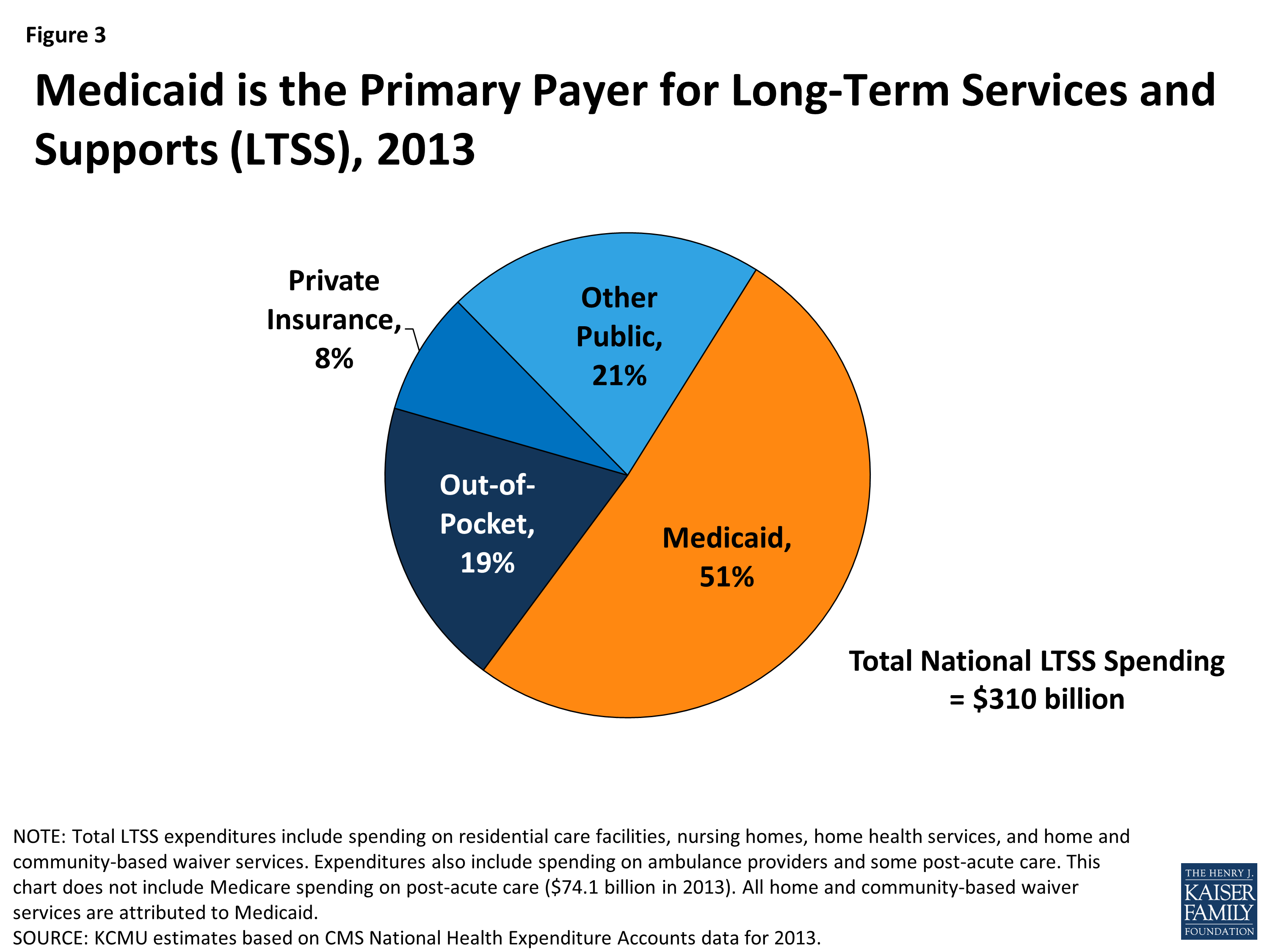

Every day until 2030 10000 baby boomers will turn 65 a and 7 out of 10 people will require long term care in their lifetime. AVERAGE Long Term Care Insurance Rates for Age 55. Long-Term Care Premium Costs by Age At Age 55 From 2018 here are samples of the annual premium based on the average of leading insurance companies.

The cost of long-term care insurance is not cheap. Unfortunately she waited just a little too long and the timing was devastating. Value of benefits when policyholder reaches age 85 equals 386500 each Single male 1870.

But thats like saying the average car is white and costs 15000. Thats why we believe it is so important to talk to a specialist before you buy. Ltc premiums average about 2700 annually or 225 per month a cost that many may not be able to afford.

There are considerable price differences across companies and policies but long-term care insurance for a couple aged 55-60 can range from around 2000 to 4000 per year.

Tax Deductible Long Term Care Insurance Tax Limits Ltc Federal Tax Limits State Deductions For Long Term Care

Long Term Care Insurance Inflation Protection Options Long Term Care Insurance

What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management

Tax Deductible Long Term Care Insurance Tax Limits Ltc Federal Tax Limits State Deductions For Long Term Care

Pin By Carole Jones On Long Term Care Long Term Care Insurance Long Term Care Nursing Home

Long Term Care It S Coming Are You Ready Ltc Long Term Care Insurance Long Term Care Life Insurance Policy

What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management

Thoughts From A Long Term Care Insurance Expert Part 2 Esi Money Long Term Care Insurance Long Term Care Financial Motivation

Nursing Home Care Vs Home Health Care Visual Ly Nursing Home Care Home Health Care Home Health Nurse

75 Must Know Statistics About Long Term Care Long Term Care Term Statistics

Your Target Long Term Care Insurance Client Long Term Care Insurance Long Term Care Disability Insurance

Medicaid And Long Term Services And Supports A Primer Kff

Tax Deductible Long Term Care Insurance Tax Limits Ltc Federal Tax Limits State Deductions For Long Term Care

Pin On Client Northwestern Mutual

How Much Does Long Term Care Insurance Cost Smartasset

Allianz Long Term Care Insurance Life Insurance Blog

Medicaid And Long Term Services And Supports A Primer Kff

Long Term Care Insurance The Basics Long Term Care Insurance Long Term Care Care

Posting Komentar untuk "Cost Of Long Term Care Insurance At Age 75"