How Do I Report My Hsa On My Taxes

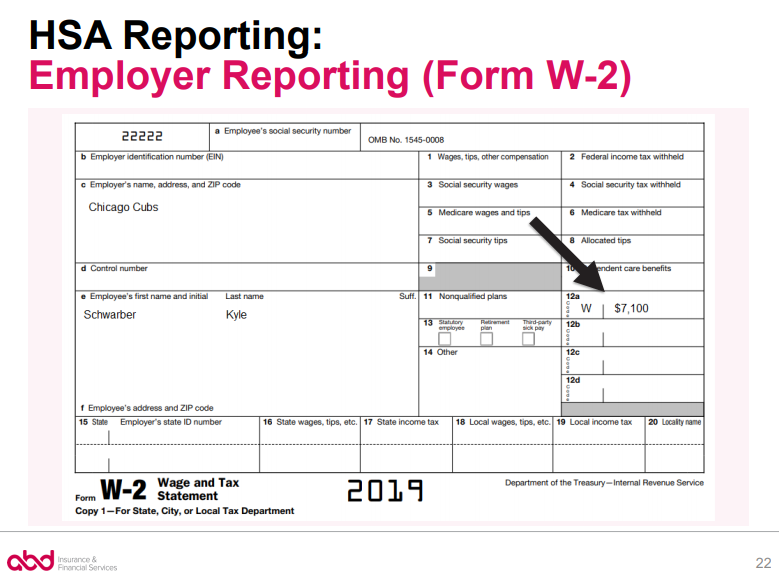

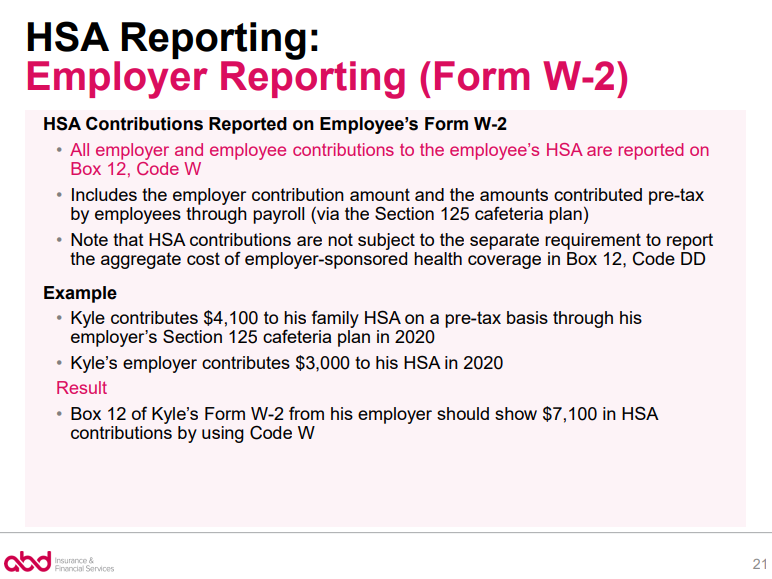

To report your HSA contributions on your tax return you will need a copy of your W-2 for the total pretax contributions made by you through payroll or by your employer. Make sure to report your 2020 HSA contributions all non-medical HSA distributions and any excess HSA contributions on Page 2 if applicable.

Instructions For Form 8889 2020 Internal Revenue Service

To report health savings account contributions distributions or to report any adjustments please go to.

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png)

How do i report my hsa on my taxes. Do i have to claim my HSA contributions on my taxes. Welcome to this final Part 8 on Health Savings Accounts or HSAs titled. Contributions to and withdrawals from HSAs are reported by the account holder on Form 8889.

Regardless of whether HSA contributions are made by you or your employer the contributions must be reported on your tax return. Adjustments to Income. The employer is required to report employer HSA contributions to the IRS on the tax return that is filed by the employer.

So the HSA deduction rules dont allow an additional deduction for those contributions. You as the account holder need to report contributions to and distributions from HSAs on IRS Form 8889 and attached it to Form 1040. Form 1095-C is a health insurance tax form that reports the type of coverage you have dependents covered by your insurance policy and the period of coverage for the prior year.

Employer Contributions to Health Savings Account. These forms are also available on the. The first is through a pretax payroll deduction.

Earnings on excess contributions withdrawn will be in Box 2 and included in Box 1. Form 8889 is used to report any distributions from and contributions to your Health Savings Account. My son pays me to babysit my grandson.

If you have a health savings account HSA you must report both contributions to it and distributions from it to the Internal Revenue Service IRS. HSA Bank will mail you IRS Form 1099-SA and IRS Form 5498-SA if you have not selected to receive them online. HSA money withdrawn for nonmedical purposes is also subject to.

I only put around 100 in and have not deducted any since Ive gotten it. Also know what happens if I dont report my HSA. Ineligible payouts are taxable and you need to report them on line 21 of Form 1040.

Whether you contribute 50 or 7100 here are the three major tax advantages you get to enjoy with an HSA. Probably not as long as they are listed on your W-2 as described below. One of the best perks of an HSA is that when you make a contribution youre adding money tax-free.

I do not want to claim child care expenses as we all share a household. What are HSA Contributions. However contributions paid through your employer are already excluded from your income on your W-2.

This means your employer drops whatever HSA funds youve earmarked to come out of your paycheck straight into your HSA. Think of this form as the place where the numbers from forms 1099-SA and 5498. IRS Form 1040 This is your individual income tax return.

My son will report child care expenses on his taxes for paying me to watch my grandson. When youre getting ready to e-file your return any money deposited into your HSA by your employer will be listed in Box 12 of your Form W-2. WEXs benefits administration participants can find the tax forms related to their HSA under the Message Center tab of their online account.

Health Savings Account Form 8889. Where do I report HSA transactions on my tax returnsNow some of you might be thin. This form is used to verify on your tax return that you and your dependents have at least minimum qualifying health insurance coverage.

Any contributions in excess of the annual contribution limits are not tax-deductible. Prepare to report distributions and contributions using tax Form 8889. You can make contributions for a tax year until that years tax filing deadline.

IRS Form 8889 This form is specific to HSAs. In other words you have until April 15 2020 to make contributions for 2019. If you did you can enjoy the savings you experienced by paying for those expenses with tax.

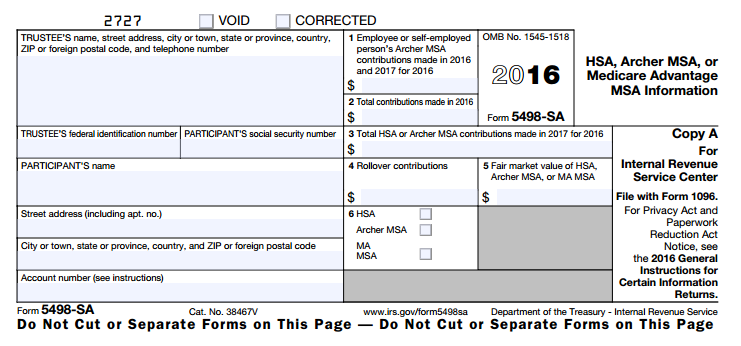

If you had a break in health care coverage for the tax year you may have to pay. If you or anyone other than your employer deposited money into your HSA you should receive Form 5498 showing how much was deposited. What HSA information do I need to report on my tax return.

In most cases your HSA contribution has already been reported in Box 12 of your W-2 with code W. Form 5498-SA will report the market value of your HSA at the end of the calendar year the total contributions made within the calendar year and the total contributions for the tax. That can happen in a couple of ways.

Report your HSA contributions to the IRS using Form 8889. Reporting Your HSA On Your Taxes Tax reporting is required if you have a Health Savings Account HSA. HSA Bank provides you with the information and resources to assist you in completing IRS Form 8889 regarding your HSA.

People Also Asked Do i have to report hsa on taxes. We all live in the same house. You may be required to complete IRS Form 8889.

Employees with HSAs must file a Form 8889 Health Savings Accounts HSAs as an attachment to Form 1040 for any year in which they make or receive HSA contributions including employer contributions or for any year in which they take an HSA distribution. The IRS will review these documents to determine whether you used your HSA funds to pay for qualified medical expenses. The IRS requires you to prepare Form 8889 and attach it to your tax return when you take a distribution from an HSAHowever if your 1099-SA indicates you did not use the distribution for qualified medical expenses you will pay income tax on the portion you used for unqualified expenses.

This is one of the forms youll mail back to the IRS for your tax return. Deposits paid directly to your health savings account HSA can result in an HSA tax deduction. Form 8889 is also used with Forms 1040-SR and 1040-NR.

Understanding Your Forms Form 1098 Mortgage Interest Statement Mortgage Interest Student Loan Interest Credit Card Services

Health Savings Account Hsa Tax Forms And Tax Reporting Explained Youtube

Important Hsa Tax Forms Information Healthsavings Administrators

The Hsa Report Card Health Savings Account Report Card Rewards Credit Cards

Hsa Form W 2 Reporting Abd Insurance And Financial Services

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png)

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Health Savings Account Hsa Tax Forms And Tax Reporting Explained Youtube

Understanding Form 8889 For Hsa Contributions And Tax Deductions

What To Do If You Accidentally Use Your Hsa For Non Health Related Expenses

So What Exactly Is An Hsa Health Savings Account Health Savings Account Accounting Savings Account

What Is Hsa Tax Form 5498 Sa Hsa Edge

Hsa Form W 2 Reporting Abd Insurance And Financial Services

Publication 502 2013 Medical And Dental Expenses Medical Health Savings Account Irs Taxes

Health Savings Account Hsa Tax Savings Health Savings Account Hsa Savings Account

Form 8889 Instructions Information On The Hsa Tax Form

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png)

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Posting Komentar untuk "How Do I Report My Hsa On My Taxes"